How do I buy a business?

Whether a one-off acquisition or as part of a ‘buy-and-build’ strategy, knowing the ideal acquisition criteria will help focus your search for the right target. This could be based on the type of business, industry, size, turnover, and location.

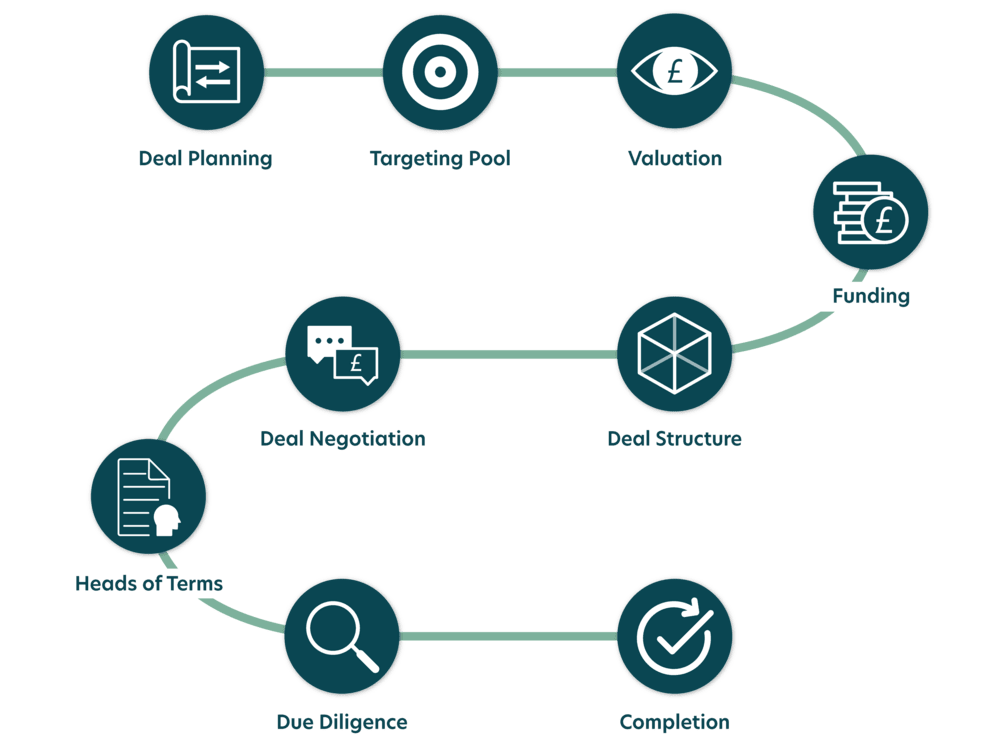

GS Verde can assist you in finding targets or can work with you to execute a deal with a target known to you already. From expressions of interest, confidentiality and non-disclosure agreements, to entering a period of exclusivity and forming, negotiating, and structuring the right deal. There will be many things to assess throughout the process, including the business's operational and financial performance, the sale timeframe, inventory status, intellectual property, staffing, and property leases, as well as other tax and legal considerations.

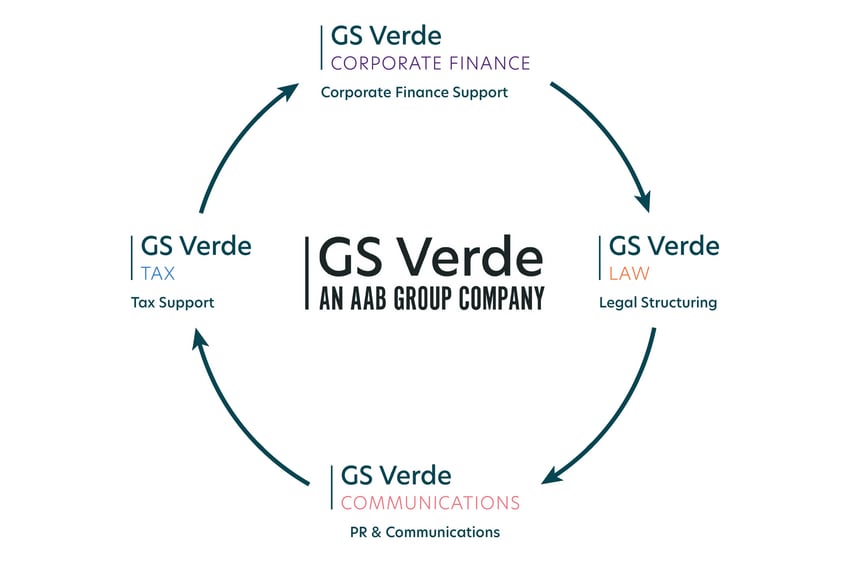

An acquisition is a big decision, so it is important to seek assistance and have the right advisors on hand. GS Verde's multidiscipline services mean you have the advice you need when you need it and can ensure the process runs smoothly through to successful completion.