Investing in growth: Making the most of R&D Tax Credits (RDEC)

posted 7th November 2022

Innovation is the key to unlocking increased productivity and progress, helping businesses to thrive amongst the competition. It comes as no surprise then that in the 20 years since the R&D Tax Relief scheme was introduced, the incentives for heightened spending on R&D activities have substantially increased.

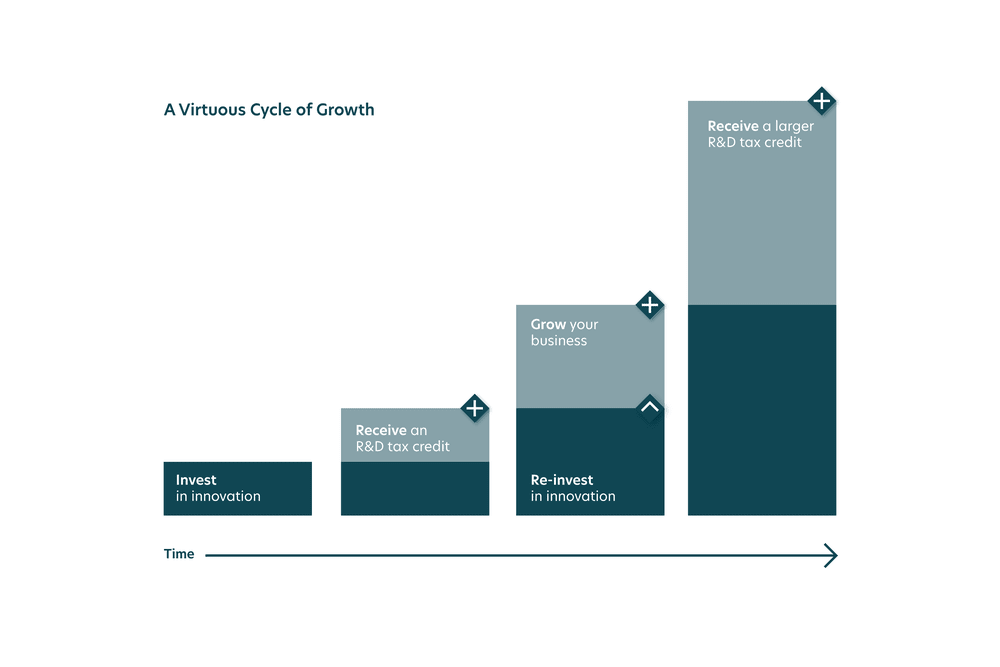

For many businesses, the cash injection from R&D tax relief can foster growth through reinvestment and lead to receiving a larger R&D tax credit the next time round. By rewarding innovation, R&D tax relief, therefore, creates a virtuous cycle of growth.

How does R&D Tax Relief work?

Businesses that spend money on their innovation can make a claim and receive up to 33% of qualifying costs in return. This can take the form of a reduction in Corporation Tax, a repayment or an R&D tax credit cash refund, depending on your circumstances and what is most beneficial to your business.

Enhanced tax relief is currently provided at a rate of 230% on qualifying spend. This equates to £46 tax relief for every £100 spent.*

Qualifying expenditure includes staffing costs, materials used, utilities, subcontractors R&D including professional fees, Capital Allowances, and indirect activities including support activities, training, research, data collection so long as they are directly related to the R&D project.

Can I claim HMRC R&D Tax Credits? Projects that qualify as R&D:

Though traditionally aimed at scientific advancement, the scope of qualifying sectors for R&D is now much wider. Any company creating a product or service that improves what is already available and involves the use of science or technology can apply.

Typical sectors engaged in research and development include:

How to make an R&D Tax Credit Claim:

Your R&D tax relief claim forms part of annual corporation tax filing. HMRC require appropriate records to be maintained to document activity, and a report setting out the nature of the project. It is also worth noting that retrospective claims can be made for the last two financial years when making your first R&D claim.

It is vital to satisfy specific HMRC R&D questions and specifications on the project. Our expert tax team can prepare the necessary reports to provide a robust recording and reporting mechanism that means the claim process is smooth and successful.

The scope of this scheme makes R&D Tax Credits one of the biggest and most effective boosts for your business – and it all comes down to submitting a comprehensive application to maximise the opportunity. Your choice of advisor can be the difference between a good and a guaranteed claim.

As part of the wider GS Verde Group, GS Verde Tax provides expert advice to companies and business owners, helping them to make practical and informed decisions. Our tailored support and guidance ensure compliance while performing appropriate R&D tax credit calculations to help maximise the reliefs available.

*Rates and relief correct at the time of publication. Updates to UK legislation might change these figures. Please contact us for the most recent information.

Submit your details below to talk to our tax specialist team about your R&D Tax Credit application.